I have to say, the interviews of the various candidates for common council that have appeared so far in the local media have been nearly to useless to me. I have no doubt the editorial response to the recent State Audit will be scathing. But when it comes to the candidate’s interviews, I’m reading softball answers to softball questions. Amsterdam’s financial difficulties have been well known for years now and have been underscored by the recent release of the State Audit. But I’ve read precious few details about how any of the candidates plan to cut expenses or raise revenue. Whether online or in print, I’m hearing a lot of rhetoric, vague ideas and finger pointing, but no solid proposals.

Please note, I’ve revised the table I had here before based on the advice from some of my commentors. I’ve posted the new table with an explanation here.

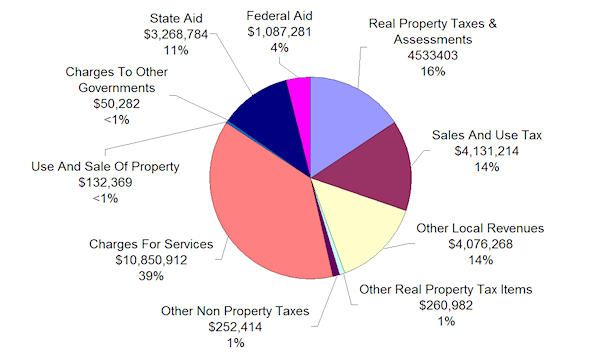

The pie charts are still good though!

The fact is the city has outspent it’s revenues in every fiscal year since 2000. Here’s the stats compiled from the NY State Controller’s website

Over the past 12 years, on average the city has overspent by 3.2 million dollars per year.

I think voters need to task our local leaders with a simple and achievable target that will get us back on track financially. I think that target should be to reduce expenditures and/or increase revenues by a total of at least $4M (or by about 11% of 2011’s expenditures) per year.

We’ve only got about a week left before the elections, but I believe that candidates (as well as the Mayor) need to provide some solid answers to the $4M question. Where do we cut? And where do we find new revenue? How do we bridge that $4M gap? Here’s the pie charts that show where the money comes from and where it gets spent. Tell me where we should slice or where we can increase…

- City Expenses 2011

- City Revenues 2011

It’s not like the data isn’t out there for candidates to do their homework. The current budget is available online. The state controller’s office also has a wealth of stats that document our finances over the years (h/t to Flippin for guiding me to this resource). You can also view the finances of every other city in NY for comparison.

I understand politicians don’t like to stake specific objectives – lest they be held accountable if they fail to reach them. But frankly, I don’t think we should continue to accept that.

Stipulation: I don’t accept a candidate pointing out a few minor expenses and then claiming “it all adds up.” If you’re sure it all adds up, show your math. Then I’ll believe you.

If you agree, feel free to share this challenge with your favorite (or least favorite) candidate.

Tim I agree with your assessment with candidate interview questions and the need for more attention to getting substantial answers to how we should deal with the financial plight of the City of Amsterdam. However, I disagree with your assessment of the status of the City’s budget over the years. Try using the Trend Report for the years 2000 to 2011. Different revenue and expenditure figures will show up which more accurately depict what happened in each fiscal year. Keep in mind we are looking at a balance sheet which includes everything accrued in a given fiscal year but does not mean that the City has necessarliy outspent itself. It includes debt accrued in a given year but that debt is like someone’s mortgage which is paid out during a certain time period usually 5 or 10 years for municipal debt which is sometimes refinanced to extend the debt payments out even further. What the numbers do show is that the City is increasing its debt service during a time when revenues are dwindling which is what should be looked at and resolved. What needs to be shown is what is the total debt owed by the City of Amsterdam and how much debt service (mortgage) is being paid from one fiscal year to another and compare that to the dwindling property tax stream or assessed evaluation. You can take up to 2% of the total assessed evaluation of a municipality which in our case is 1% due to a self imposed tax cap and which involves an eroding total assessed evaluation along with the fact that approximately 38% of our assessed value is tax exempt. So you see unless you have been doing municipal budgets for a while it is hard for someone new coming in to understand its complexitiy.

Thanks Bill, I believe you when you say it is more complex that what is shown here and I kinda had a feeling that was the case but I figured I would start somewhere.

Please tell me if I understand you correctly – if, for instance, the city borrowed $1000 to buy something in a given year, and that money was spent that year, then the $1000 is included in the “expenditures” figures that the state provides? Even though that $1000 is actually paid off over 5-10 years? But that $1000 is not included in “revenues” – so the numbers are off balanced based on how much was borrowed. Is that right or am I still missing it?

Can you point me to the trend reports that you mentioned? I don’t see anything named that on the State Controller’s web site.

I think voters need to have a better idea of what is happening financially with the city – somehow simplified so the average person can get it, and that’s what I am working toward here. I appreciate your input on this!

You are basically right. Any monies taken out by a bond/loan and expended in a given fiscal year would be considered an expenditure for that fiscal year even though the City has either 5 or 10 years to pay it back. However, what did happen in Amsterdam and in other communities is e.g. the City bonded $3 million for a project but only expended $2 million in a given fiscal year the $1 million was considered revenue but in fact could not as it was borrowed not raised money. This skews the numbers and the big picture. A thorough audit would find this and correct it. In addition, all bond money is borrowed for a specific project(s). If a municipality uses these monies for something else it will have to pay back the loan often with interest. The problem with Amsterdam’s finances and that of many upstate communities like ours is that the total assessed value of our community is eroding meaning that our tax base is dwindling, too many properties are tax exempt, there is no development occurring that would eventually raise the tax base, debt service(mortgage payments) is increasing, and the cost of running the government is increasing like everything else in our lives. This all results in high property taxes which often have a side effect of increased foreclosures decreasing the number of property tax payers footing the government’s bill. The way to resolve this is a multi facet approach that includes cleaning up our deteriorated sections of the city to provide room for new development, stronger code enforcement to protect the appearance of our current housing and commercial stock, reduce the number of tax exempt properties or arrange for payments in lieu of taxes, consolidate functions with the County, look at consolidating with adjacent municipalities keeping Amsterdam name intact, etc. We can’t function like we did years ago when we had the mills and GE. We are not in dire straits but if we continue as is we will be.

Tim,

Great post. I think there is some confusion here about balance sheets versus income statements.

What you have outlined in your post and what you are asking candidates to answer centers on revenues and expenses– this is the income statement. Any debt incurred is part of the balance sheet and is NOT directly part of the expenses or the revenues. In short, balance sheets and income statements are related but distinct.

To your example, if the city borrows $1000 through a bond, two things should happen (to keep it simple).

First, the bond would immediately change the city’s balance sheet: $1000 dollars would be added to liabilities and $1000 would be added to cash (usually restricted per the terms of the bond). So far, nothing has happened to expenses and/or income so this would have no impact on the income statement. In other words, the fact that the city took a bond does not change its income statement immediately.

Second, the city , at some point, starts to spend the cash on some project associated with the bond, let’s choose paving roads as an example. At the point that the city starts to spend money on paving roads to pay the contractors, utilities, etc , that is when expenses would be incurred. So if $800 is spent in 2013 to fix roads and $200 is spent in 2014, the expenses would appear in the year in which it was spent– $800 in 2013, and $200 in 2014.

Meanwhile, the city needs to pay back its bond which you would see reflected in expenses under “debt service” , “interest” or something similar to tell you that those expenses relate to paying off debt. So when looking at the city’s books, the expenses related to the $1000 bond may appear under different expense categories. Also, the interest expenses related to a bond may appear many years after the bonded project is complete if it is a long-term bond, say 10 or 20 years.

At no point should the bond money be considered revenue — it is not and should not be considered revenue under any proper financial management.

What makes the city books more complex than this simple example is that the city uses accrual accounting so the timing of when bonds and revenues “hit the books” is not always as straightforward as this example. Still, the underlying principles remain the same.

It’s important to keep expenses/revenues as distinct (albeit related) to debt. In no case, should the city’s bonding be considered revenue.

Well done Tim!

OK, what you are saying seems to jive with what Bill is saying.

Maybe the way to correct the chart is to simply take out the debt service numbers. The revenue numbers would still be skewed, but this would make it similar to a business “Profit/Loss” statement. If I use a business credit card to pay for a service in a given month, I count the expense for that month in my P&L but I do not count the credit card payment. If I’m looking at cash flow, I look at the credit card payments, but I don’t look at the credit card statement. Make sense?

Or maybe a different way of looking at it is to simply look at the graph you did a while back, and look at when the debt amount started to rise steeply (around 2006) and say that.since 2006 our debt has increased at about 2M per year and maybe that should be the number to target.

Obviously, it’s still oversimplified. But it’s still a heck of a lot closer to an informed discussion than saying that buying flowers or rams is what’s causing our financial problems.

Tim,

I think the main question on the city financials is actually the debt service figure as the key question is whether the city can support its rate of debt growth versus its rate of growth in cash flow. If you take the debt service out, I’m not sure where that leads.

A few thoughts on your post:

– I totally agree with you that candidates should clearly articulate how to solve the city’s financial issues without harping about rams and flowers. However, I expect space aliens to visit our fair city before a candidate actually confronts the reality — you either have to radically cut services or raise taxes. No candidate will ever admit that so you can expect the continuing gibberish which does nothing to confront the real problem. We have candidates harping on 3 figure expenses when the issues facing the city are 7 and 8 figure issues.

– The city’s debt service is not subject to the tax cap so it is not surprising that city leverages that to maintain services and perform necessary capital projects.

– The city’s worsening condition is caused by the tax cap — you cannot have it both ways that city finances would improve when the city’s costs are rising and its revenues are not keeping up at the same rate.

-The focus on expenses without looking at revenue and growth is why we find ourselves here today. If you choose to not grow or promote growth policies, you by default are raising taxes no matter how you harp about taxes or expenses.

Done soapboxing for the day.

Yes, mostly agreed. However, the only way reduce the debt service is to start spending within our means and stop borrowing so much. It seems the only way to show that clearly and accurately is with a P&L type statement which shows the overspending.

[…] You can choose to become informed on the city’s finances and fiscal policy by careful, thoughtful analysis and research by the unfunded, volunteer efforts of TIm Becker here and here. […]